Vennfi Raises $3.7M to let Anyone Donate Stocks and ETFs with a Free Personal Charitable Foundation

Vennfi, the financial technology company for tax-exempt payments, announced its close of a $2.3M Series Seed fundraise. The round was led by seasoned fintech investor Tom Blaisdell, formerly of DCM Ventures. Teamworthy Ventures, Duro.vc, Sovereign’s Capital, and Promus Ventures participated in the round, alongside several return backers and new mission-aligned funds and individual investors. In total, the venture will have raised $3.7M over the last 9 months.

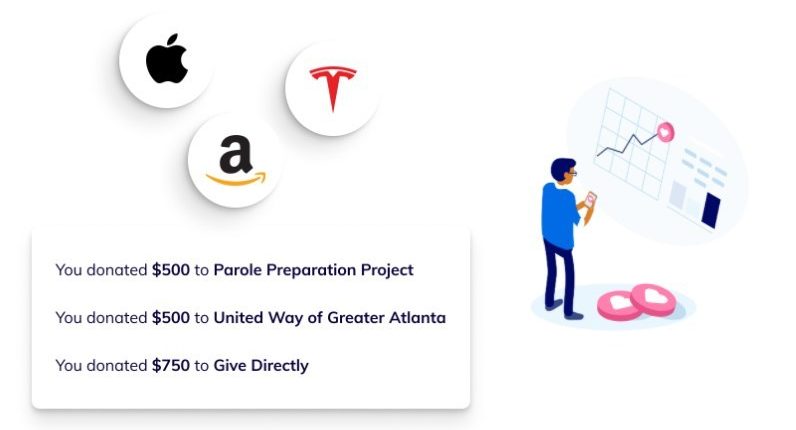

The company’s flagship platform, Charityvest, lets anyone instantly create a tax-deductible charitable giving account, known as a Donor-Advised Fund (DAF), which acts like a personal charitable foundation. Users can make tax deductible contributions of cash, stock, or cryptocurrency to their fund, direct donations at any time to over 1.4M nonprofits in the US from their fund balance, send gifts of charitable money to friends and family, and keep track of all of their giving activity with a single consolidated tax receipt.

Additionally, the platform helps companies automatically match their employees’ charitable giving with smart budgets and compliance tools. The corporate matching offering, called Charityvest for Workplaces, has been adopted by dozens of organizations and thousands of employees since it was publicly announced at Y Combinator’s Summer 2020 demo day in August. Employers can launch a charitable matching program in minutes and employees appreciate the easy to use, flexible interface.

On Giving Tuesday (December 1, 2020), Charityvest will launch zero-fee stock contributions, allowing users to make donations of appreciated publicly-traded stocks and ETFs, directly to their fund, from any brokerage. Donating appreciated stock has substantial tax advantages – mostly through the avoidance of capital gains taxes, and the consequential larger charitable income tax deduction – that result in more funds being available for giving to charities.

“Charityvest’s zero-fee stock giving feature is the first of its kind, enabling both individual donors and employees of companies that use Charityvest to make a tax-deductible gift of securities to their fund, and use the cash proceeds to support one or more charities with just a few clicks,” said the company’s CEO Stephen Kump. “With financial markets at all-time highs, we see stock giving as a highly efficient way to intentionally set aside financial resources for generosity.”

Charityvest uses donor-advised funds (DAFs), which have traditionally been marketed to wealthy donors. The platform has dramatically reduced the complexity and cost of DAFs, and offers its funds with zero fees and low contribution and grant minimums – only $20 to get started. Since Charityvest’s launch, two major incumbent DAFs – Fidelity Charitable and Schwab Charitable – have also lowered their minimums.

“Being generous makes people happier, and Charityvest makes being generous easier,” said lead investor Tom Blaisdell. “This is yet another example of taking a financial vehicle – donor-advised funds, in this case – widely used by wealthy families and individuals to simplify and amplify their charitable giving, and applying technology to make it simple and inexpensive enough for everyone to take advantage of it. I’m excited to be involved in helping Charityvest make the world more generous.”

Contact:

Ashby Foltz

Related Images

Turning stock gains into charitable good

Charityvest’s stock donation feature lets anyone contribute appreciated stock to their free personal charitable foundation, for free. The company will make the feature public on Giving Tuesday, December 1.

Related Links

Workplace giving matching program